📈 Everything is a Data Business - on Kroll-StepStone Private Credit Benchmarks - Asymmetrix Newsletter #83

Businesses are leveraging data they obtain in the course of regular business operations to create Data & Analytics assets

Last week risk advisory provider Kroll and private markets financial services business StepStone announced that they had launched a Private Credit Benchmarking Data & Analytics product.

Asymmetrix thought we would dig in and think through the implications of this move.

What is Kroll and StepStone’s motivation?

How does this fit within the trends in Data & Analytics?

What is the shape of the Private Credit Data & Analytics market? (*Logo map alert*)

What does the future for the sector look like?

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📈 Everything is a Data Business

We deviate from our regularly scheduled programming this week and discuss the recently reported Kroll-StepStone partnership.

The partnership between the financial and risk advisory firm Kroll (not the bond rating agency, KBRA) and the institutional investment consultant / asset manager StepStone will see the creation of private credit benchmarks, aptly named the Kroll StepStone Private Credit Benchmarks.

The benchmarks will be available on Kroll’s Private Capital Markets Platform, the firm’s private asset valuation platform that captures clients’ investment data to enable streamlined valuation workflows. The benchmarks will include data from more than 15,000 direct-lending deals in the US and Europe since 2012. In their roles advising and allocating/investing on behalf of clients, respectively, both firms have seen their fair share of private debt deals and invested a good deal in compiling – and merging – their deal databases.

Though neither Kroll nor StepStone fit the bill as Data & Analytics businesses, to say the least, the line of reasoning that may have led both to believe that building a private credit data product is a worthwhile endeavor is coherent:

Private credit is a big and growing asset class;

We are keen to win more business advising stakeholders on private credit deals;

We have done plenty of work analyzing deals in the asset class over the years;

We have created an internal database to record data on those private credit deals we have worked on...

…so we should join forces with a like-minded (but not competitive) firm that also has high quality data to build a side-hustle data product that:

We can sell into our target market in our day-to-day job as an financial advisor or investment consultant;

Creates another touchpoint with clients and operates at relatively high margins;

We can leverage to become the industry standard for assessing private credit performance and valuations, which will make us a household name and in turn, pave the way for us to win more business.

Impressively both parties have got together and not only agreed to share data but have actually managed to follow through and deliver.

---

Kroll StepStone Private Credit Benchmarks underscores two trends Asymmetrix are seeing throughout the world of data, consulting and professional services:

Many businesses sit on a data asset they can leverage outside their core products or services

Businesses are increasingly looking to add data products alongside their primary services

If businesses can leverage data they obtain in the course of regular business operations (analyzing private credit deals, for example), the data product they can build with that primary-source data can be powerful. Of course, businesses may be prohibited from sharing specifics, such as specifying a particular deal’s valuation or terms, but even aggregated and anonymized data is valuable if highly accurate.

Asymmetrix have found professional services and financial advisory firms to be particularly likely to launch data products or businesses; see, for example, Littler Mendelson’s ComplianceHR, Bain’s OPEX Engine or GLG’s Library, among others.

These data products are sometimes intended to diversify revenue with a high-margin, recurring revenue business that is more scalable than their core, low margin, labor-intensive services business (as in GLG). More often, these products are seen as another hook to engage clients and a medium to continuously add value without being a core strategic focus in and of themselves. In the case of the Kroll StepStone Benchmark, the goal is both to engage clients with value-add data and more broadly to build their brands in the private credit market.

What does all this mean for investors in Data & Analytics companies? In our estimation, data and research products that are secondary or tertiary to companies’ main products or services may eventually run their course for the parent company. Over time, they may no longer provide strategic value, become too much of a drag on cash flow if not scaled, or simply be a distraction.

At that point, parent companies may look to divest these businesses. In recent years, we have seen a few instances of such carveouts of non-core businesses:

Inflexion and Endicott Capital’s acquisition of regulatory research provider aosphere from law firm Allen & Overy;

Verdane-backed Corlytics’ acquisition of Deloitte UK’s RegTech platform;

Forian’s acquisition of healthcare and financial services data provider Kyber Data Science from TD Cowen.

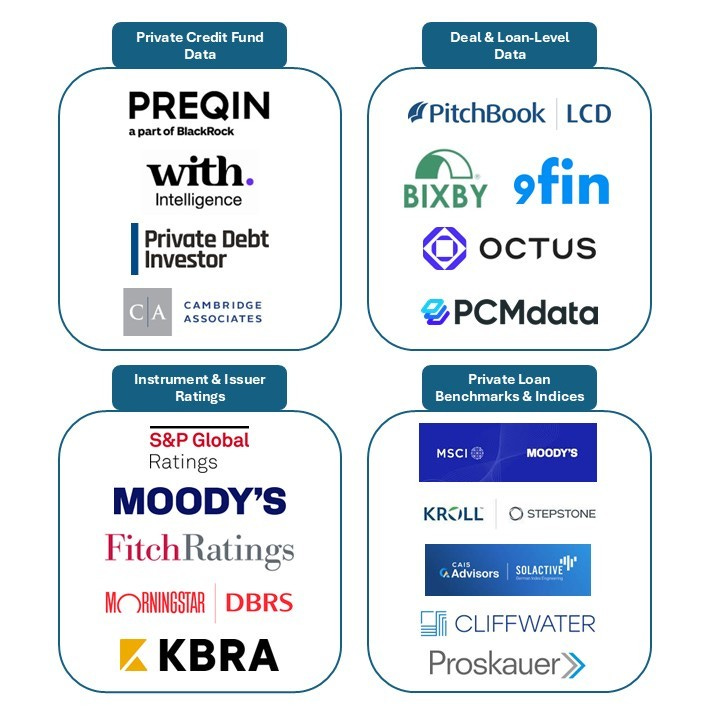

Back to the matter at hand – where does the Kroll StepStone benchmark product fit among the market of private credit data providers? Asymmetrix segments the market as follows:

Fund Data: Preqin (BlackRock), With Intelligence, Private Debt Investor (PEI Group), Cambridge Associates;

Deal & Loan-Level Data: LCD (Pitchbook), Bixby Research & Analytics (Fitch Solutions), 9fin, Octus (formerly Reorg Resarch), PCM Data;

Ratings: S&P Ratings, Moody’s, Fitch Ratings, Morningstar DBRS, KBRA;

Private Loan Benchmarks & Indices: MSCI + Moody’s, Kroll + StepStone, CAIS + Solactive, Cliffwater, Proskauer.

Interestingly, none of the independent data providers in the Deal & Loan-Level Data segment offer benchmarks or indices, likely because none have access to enough granular loan data to create a representative benchmark.

Of the benchmark providers, only MSCI and Moody’s are pure-play data providers. However neither came to market with a benchmark solution on their own, relying on MSCI’s access to fund manager and deal data (presumably via Burgiss) and Moody’s risk modeling solution, EDF-X.

All told, Asymmetrix are keen to see the development of the private credit data market. Private credit as an asset class is still experiencing growing pains and we will likely see more data platform scome to market addressing different points in the private lending value chain.

Zooming out, the broader private markets/alternative asset data space has been extremely active; we expect more private credit data solutions to be in the crosshairs of strategics soon enough.

As for Kroll StepStone Private Credit Benchmarks, what the future holds is unclear. Kroll and StepStone currently don’t appear likely to build this private credit benchmark into a broader private credit data platform selling directly to investors on a subscription basis, including hiring a sales team, contemplating tuck-ins, or setting up offshore data collection operations, as a full-fledged Data & Analytics business may do.

But given Jules Kroll’s history of launching business – Kroll, KBRA, K2 Intelligence amongst others – you should never say never.

📜 Interesting Content

How a former junior lawyer created a $5bn AI legal start-up - FT

If you would like access to Asymmetrix’s underlying data via our subscription product, contact us directly at asymmetrix@asymmetrixintelligence.com