💰 How will S&P Global and CME Group spend their $3.1bn OSTTRA windfall? - Asymmetrix Newsletter #63

S&P Global seem more likely to splash out on transformational Data & Analytics acquisitions than CME Group

S&P Global and CME Group sold their post-trade services joint venture OSTTRA to KKR for $3.1bn last week, sharing the proceeds 50/50.

In this week’s newsletter we consider what acquisitions each company might spend their share of the money on.

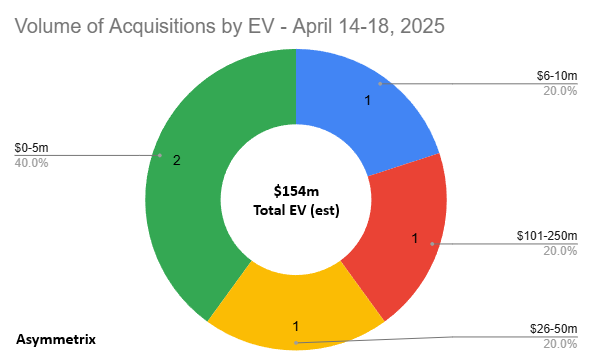

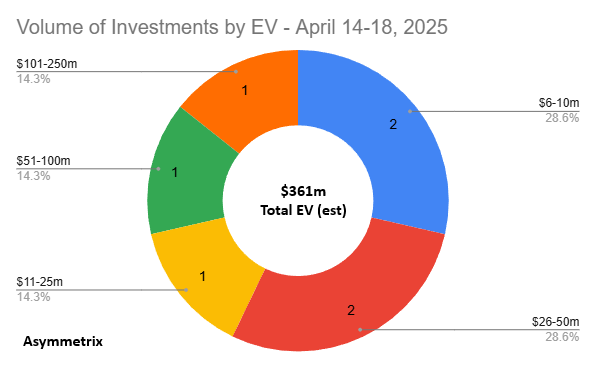

It was a relatively low key week otherwise, with 5 disclosed acquisitions, with a total estimated EV of $154m, and 7 investments announced, with a total estimated EV of $361m.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Acquisition and Investment activity - April 14 - April 18, 2025

There were 5 disclosed acquisitions, with a total estimated EV of $154m.

7 investments were announced, with a total estimated EV of $361m.

If you would like access to Asymmetrix’s underlying data via our subscription product, contact us directly at a.boden@asymmetrix.info.

Reinvesting the Proceeds

What happened?

Last week, S&P Global and CME Group sold their post-trade services joint venture, OSTTRA, to KKR for $3.1bn.

This transaction had been anticipated for over 6 months, with Bloomberg reporting on the start of the process back in August last year.

Launched in September 2021, OSTTRA was 50/50 owned by CME Group and IHS Markit, and provided post-trade solutions for the global OTC markets across interest rate, FX, equity and credit asset classes. It incorporated CME Group's optimization businesses – Traiana, TriOptima, and Reset – and IHS Markit's MarkitSERV (acquired by S&P Global in December 2020).

Why it matters

Both CME and S&P Global will likely be pleased to have completed the sale during challenging times.

Given our focus in this newsletter, we are less interested in digging into OSTTRA’s future than we are in divining the impact for S&P Global and CME.

How will these two Data & Analytics giants utilize their respective $1.5bn+ windfalls?

To understand their potential next moves, let’s take a look at their acquisition strategies.

What happens next?

S&P Global

S&P Global is a $141bn market cap Data & Analytics giant, split into 5 divisions:

Market Intelligence - provider of financial and industry data, research, news, and analytics to investment professionals, government agencies, corporations, and universities. S&P Global Market Intelligence was born out of the integration of S&P Capital IQ and SNL Financial in 2016;

Ratings - provides independent investment research including ratings on various investment instruments;

Commodity Insights - provider of information and a source of benchmark price assessments for the commodities, energy, petrochemicals, metals, and agriculture markets;

Mobility - provider of automotive data, analysis and insights;

Dow Jones Indices - world's largest global resource for index-based concepts, data, and research. It produces the S&P 500 and the Dow Jones Industrial Average. S&P Dow Jones Indices calculates over 830,000 indices.

Since Martina Cheung took over as CEO of S&P from Doug Peterson in November last year, we have not seen a noticeable change in overall direction, so it seems safe to assume that the strategy outlined in their most recent Investor Factbook is still correct.

According to that, S&P Global is interested in acquisition opportunities that:

Augment benchmarks, proprietary data, and tools and analytics capabilities;

Provide geographic diversification;

Bolster recurring revenues;

Provide synergies.

They are particularly interested in “transformational adjacencies” of Sustainability, Energy Transition and Private Markets.

So what assets of scale at around the $1.5bn EV mark might they acquire in each area? A few ideas below:

Sustainability

Enhesa - the first of two CGE-backed assets, Brussels-based Enhesa checks all the boxes for growth, geography and proprietary datasets. Under CGE’s majority ownership Enhesa has grown through multiple acquisitions, and has an interesting focus on chemicals, whilst also covering other EHS-related areas.

Energy Transition

Aurora Energy Research - we wrote in depth about this second, fast-growing CGE-backed business back in September when news broke that an M&A process is under way. Power generation Data & Analytics provider Aurora covers all fuel types but has a real focus on the energy transition.

Private Markets

Sourcescrub - the financial analysts’ friend last raised funding (from Francisco Partners and Mainsail Partners) back in September 2021. After missing out on Preqin last summer, Sourcescrub would make an interesting alternative.

CME Group

Any potential acquisitions by CME are harder to determine. CME is far less acquisitive than S&P Global. Its last major acquisition was electronic FX and fixed income cash execution platform provider NEX Group plc in 2018.

Putting its Markets and Services businesses to one side, CME’s Data businesses are spread across Interest Rates, Equity Indices, Energy, Agriculture, Metals, Cryptocurrency and FX.

Here are a few acquisition ideas across those sectors at roughly the price point CME can afford with the OSTTRA money:

Interest Rates / FX

Macrobond - Francisco Partners acquired a majority stake in the Malmo, Sweden-based economic, aggregate financial and sector time-series data provider from Nordic Capital in July 2023 (although Nordic retain a stake in the business). Independent players of scale in this space are hard to come by.

Agriculture

Expana - formerly known as Mintec, Five Arrows acquired a majority stake in the business from Synova in February 2022. Expana covers a lot of ground, with pricing data and intelligence across animal protein, grains, oilseeds & fats, feed additives, tropical softs, nuts, dried fruit & food ingredients, fruits, vegetables & juices, energy & transport, metals & industrials and packaging.

Metals

Benchmark Mineral Intelligence - Rare Earths to Electric Vehicles price reporting agency and intelligence provider Benchmark has continued to grow under Spectrum Equity’s ownership since we profiled it in this newsletter in April last year. Would be a great fit.

Interesting Content

Expert network market size - Inex One

Saugata Saha pilots S&P’s way through data interoperability, AI - Waters Technology (via S&P Global)

Information Economies and Institution Economies - Byrne Hobart, The Diff

What can property portals learn from the demise of aggregators? - AIM Group

📧 If you would like to talk, please email us at a.boden@asymmetrix.info.