Prediction markets as data providers - Asymmetrix Newsletter # 98

As prediction markets make their way into mainstream media and banks open prediction market trading desks we consider their value as sources of real-time market sentiment

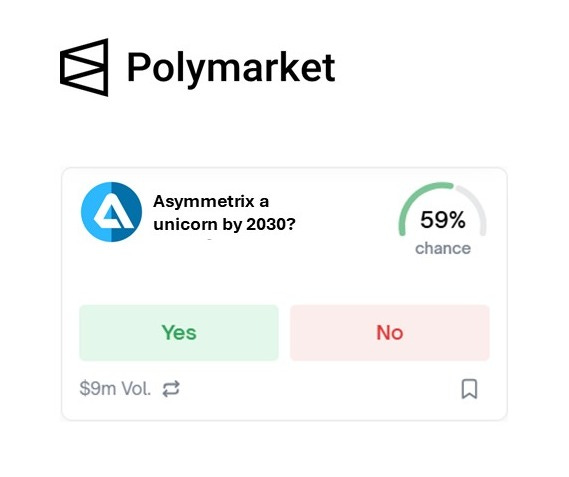

In this week’s newsletter we discuss two recent partnership deals struck by Polymarket - one with media conglomerate Dow Jones and one with residential real estate data provider Parcl. Both deals underscore the view that prediction markets are a high-quality source of real-time data and market sentiment on future economic, political and cultural events.

As ever, if you would like to have access to Asymmetrix’s underlying content and data via our subscription product, contact us directly at asymmetrix@asymmetrixintelligence.com or via our website www.asymmetrixintelligence.com.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Polymarket partners with Dow Jones

Prediction markets have consistently been in the news in the past year. Going forward, they will always be, literally.

Media conglomerate Dow Jones, the publisher of the Wall Street Journal, Barron’s, MarketWatch and several other media properties, has announced a partnership with prediction market Polymarket. Per the agreement, Polymarket’s real-time odds for economic, political and cultural topics will be displayed alongside content across Dow Jones’ online platforms. Dow Jones will also introduce a custom earnings calendar with prediction market expectations for corporate performance as part of the partnership.

Dow Jones’ announcement follows similar integrations between Polymarket and other media outlets, as well as partnerships between rival prediction market Kalshi and media outlets like CNN and CNBC. More broadly, it reflects the increased stock corporations and consumers are putting in the value and relevance of crowd-sourced market sentiment and signals.

Dow Jones CEO Alma Latour said that the company decided to make prediction market data accessible to users “because it’s a rapidly growing source of real-time insight into collective beliefs about future events” and, ultimately, the company’s goal is to “help consumers better interpret market sentiment and assess risk alongside traditional financial indicators.”

When one of the most respected voices in business and financial markets displays prediction market data alongside its news, it speaks volumes about the penetration of prediction markets and their increasing credibility as sources of data.

Polymarket partners with Parcl

Parcl, a residential real estate data provider, recently announced a partnership with Polymarket to launch real estate prediction markets powered by Parcl’s daily housing price indices for US cities.

With the Parcl partnership, Polymarket users will be able to wager on whether home values will rise or fall in major US cities. Institutional investors can analyze the data on market expectations to understand how buyers and sellers will price homes in a given market, an important indicator in their analysis of investment opportunities.

According to Parcl’s CEO Trevor Bacon, residential real estate prediction markets “offer a transparent, market-driven signal that reflects how participants are collectively pricing future housing outcomes.” In other words, Polymarket-Parcl odds data can serve as a leading indicator of where buyers and sellers will price homes.

Asymmetrix’s working view is that any analysis of prediction market odds, however, must also consider the volume traded and therefore how representative the odds truly are. Additionally, odds data relating to a specific event should be aggregated across all prediction markets and still only be used as a supporting metric alongside conventional research methods and metrics.

Prediction markets as data providers

Prediction markets, can, indeed, serve as an indicator of market sentiment relating to a particular future event, such as a sports match or whether home prices will rise or fall in a particular metro area. Such was the case in November 2024, when Polymarket more accurately predicted Donald Trump’s presidential victory than pollsters. At their best, prediction markets can serve as arbiters of market sentiment – crowd-sourced data at its finest.

Regulatory wrinkles

A persistent thorn in the side of prediction markets has been the debate around insider trading. Unlike traditional markets, prediction markets lack clear regulations and often have poor – if any – KYC processes, enabling insiders like politicians or company executives to trade on insider information. As a result, traders with material non-public information, whether relating to tech company product launches or the capture of former Venezuelan President Nicolas Maduro, can skew prices and profit massively.

Prediction markets will eventually face a reckoning and address the issue of insider trading head on. The CEOs of the two heavyweights in the space – Polymarket and Kalshi – have divergent views on the matter. Shayne Coplan, the CEO of Polymarket, has asserted that while it may negatively impact the integrity of prediction markets, insider trading is a feature, not a bug. According to Coplan, if the goal of prediction markets is to “get a signal about what’s happening in the world, then you actually want insider information.” Tarek Mansour, the CEO of Kalshi, recently endorsed a bill banning insider trading on prediction markets. Kalshi’s platform bans the practice, though it may not be illegal, regulation notwithstanding.

Despite limited focus in Congress or at the CFTC on reining in insider trading on prediction markets, it seems inevitable that some guardrails will be put in place. Regulators’ position vis-à-vis insider trading on prediction markets will impact their utility and accuracy as indicators of market sentiment relating to future events.

If insider trading is allowed, prediction markets will continue to be hugely valuable as a source of forward-looking information. Market participants and firms incorporating prediction market odds into, say, the movement of public company stocks, will bake in the possibility – or likelihood – that prediction market odds reflect some insider information, and therefore assign a greater weight to prediction market signals.

If, however, insider trading is banned on prediction markets and made illegal, they will become far less valuable and less reliable as a high-fidelity signal. Sure, crowd-sourced market sentiment or signals culled from prediction markets are a valuable input into investment decisions, but they will not be viewed as a reasonably accurate predictor of future events if insider trading is banned – at least not until years of data can support the thesis that prediction markets more accurately forecast events than any other signal.

(Ex)change it up

Their value as sources of information notwithstanding, prediction markets are valuable in that they offer users a medium for purchasing unique events contracts that consumers and corporation cannot access on traditional markets.

For one, Polymarket traders can now hedge against the price of their home increasing or decreasing thanks the company’s partnership with Parcl. Others have suggested using prediction markets to hedge against uninsurable properties or as a way to short private companies, among other creative financial products.

What this means for the Data & Analytics sector

Prediction markets’ serve as sources of data and market sentiment on particular events. To wit, alongside its $2bn investment in Polymarket in 2025, Intercontinental Exchange (ICE) became a distributor of the company’s event-driven data, providing customers with sentiment indicators on topics of market relevance. Asymmetrix expects increased institutional use of prediction markets as a forward-looking market signal as they see more trading volume;

Sector-specific data providers, like Parcl, can partner with prediction markets to offer markets in their sectors, serving as the source of truth for market settlement. Asymmetrix expects more such partnerships in the near-medium term.

📜 Interesting Content

Tracking Insider Trading on Polymarket Is Turning Into a Business of Its Own - Gizmodo

Inside Nordic Capital’s $250m bet on financial market data - Financial News

If you would like to have access to Asymmetrix’s underlying data via our subscription product, contact us directly at asymmetrix@asymmetrixintelligence.com or via our website www.asymmetrixintelligence.com.