🍹Predictive Intelligence in Retail & Consumer Data & Analytics - Asymmetrix Newsletter #68

Using AI to profile tastes and predict trends is driving growth in Consumer & Retail Data & Analytics

We begin today with a heartfelt thanks to the team at Plural Strategy for putting on their Value Creation in Information Services 2025 event last week.

Plural organised a truly insightful, CEO-level all-day event full of useful panel sessions, interviews and networking opportunities. Check out their LinkedIn post for detail.

In today’s newsletter we dig into the world of Retail & Consumer Data & Analytics, inspired by two deals that closed last week: SPINS’ acquisition of Lucky Labs, and Datassential’s acquisition of Brizo FoodMetrics. We look at the dynamics driving growth in the space, and consider what we further consolidation we might see in future.

Last week saw 6 disclosed Data & Analytics acquisitions, with a total estimated EV of $1.78bn, and 8 investments, with a total estimated EV of $937m. While Regeneron’s acquisition of 23andme for $256m got all the attention, the big deal in the sector was Thoma Bravo-backed Nearmap’s acquisition of P&C Data & Analyics provider itel from GTCR for an estimated $1.3bn.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📈 Acquisition and Investment activity - May 19-23, 2025

There were 6 disclosed acquisitions, with a total estimated EV of $1.78bn.

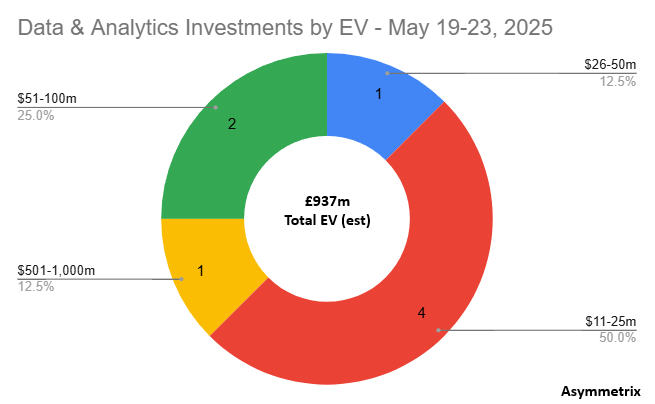

8 investments were announced, with a total estimated EV of $937m.

If you would like to have access to Asymmetrix’s underlying data via our subscription product, contact us directly at a.boden@asymmetrixintelligence.com

🔮Predictive Intelligence in Retail & Consumer Data & Analytics

Retail & Consumer Data & Analytics is huge. Naturally, it correlates with consumer retail spend - forecast to grow by 6% in 2025, equivalent to $3.2tn of additional spend.

The 800-pound gorilla in the sector is NIQ, who produced the above forecast. NIQ was acquired by Advent in 2021 and combined with GFK in 2023, creating a cross-vertical behemoth.

However, as with most Data and Analytics sectors, Retail & Consumer Data & Analytics breaks down into multiple sub-sectors.

What happened?

Last week saw two transactions in niche sub-sectors of Retail & Consumer Data & Analytics

Firstly, SPINS, a consumer health and beauty-focused data provider backed by Warburg Pincus, General Atlantic and Georgian, acquired Lucky Labs, a beauty and wellness Data & Analytics provider. Since SPINS’ 2021 funding round they have also acquired Pinto and The Data Council.

And New Mountain Capital- and Endicott-backed, food and beverage-focused Datassential acquired Brizo FoodMetrics. This was Datassential’s second acquisition in three years and their first since Endicott’s investment.

Why it matters

As ever in Data & Analytics, richer and deeper datasets mean stickier and more valuable products, and more predictable revenue streams.

Forecasting data is particularly valuable and both of these providers have data that enables their respective clients - whether retailers or restaurants - to be able to make forward-looking decisions.

In a recent article by Eugen Kaprov in his New Bioeconomy Substack (thanks to Jared Bochner for flagging) entitled “Food is just data with a shelf life”, the author outlines how data generated by AI from scanning social media platforms enables FMCG companies to tailor their product development, innovation and acquisitions to upcoming trends.

This sector is evolving rapidly. Mr. Kaprov outlines multiple innovative data providers in this area in his post. Here’s his graphic:

In the era of Trump tariffs, we can expect increasing pressure on consumer spend, particularly, in the near term, in the US, the world’s largest consumer market. Skating to where the puck is going to be will be ever more vital for retailers and manufacturers.

Recent acquisitions bear out this focus. In April NIQ acquired Gastrograph AI and in March GlobalData purchased Ai Palette, both businesses with a focus on using AI to rapidly collect and transform data, enabling it to be used for profiling and predicting tastes and trends.

What happens next?

We can expect to see further consolidation in Retail & Consumer Data & Analytics broadly and within specific sub-verticals.

Certainly we can expect to see the large players in the sector continue to mop up both smaller providers and AI-driven businesses.

Expect to see NIQ making multiple acquisitions each year, and both SPINS and Datassential continue to add bolt-ons under private equity ownership as they progress towards an exit at an unspecified future point (perhaps soon for SPINS given that they have already been under their current ownership for 4 years).

But might we see horizontal consolidation as well?

NIQ provides data on consumer packaged goods and also Technology and Consumer Durables. Why not other consumer-purchased services or content too? All are subject to the same modish consumer whims, driven by and monitorable across social media. Current demands for kimchi, K-pop, and Korean drama are all part of the same consumer trend for anything Korean.

With the power of artificial intelligence interrogating all available data in real time, all consumer tastes can be predicted, packaged up and sold as Data & Analytics to the Retail & Consumer supply chain.

📧 If you would like to talk, please email us at a.boden@asymmetrixintelligence.com

I guess ad network in a not so distant feature will know our taste buds :)