🚙 S&P Global to spin off $1.6bn revenue Mobility business - Asymmetrix Newsletter #65

Another week, another important announcement from the world's biggest Data & Analytics company.

The way things are going, the Asymmetrix newsletter is at risk of becoming overly S&P Global-centric. But what can we do? S&P Global keep announcing news that requires analysis. This week it was the news that they are going to spin out their Mobility segment. And it would have been remiss of us not to comment on an event we forecast back in December, as one of our predictions for 2025.

(As an aside, looking back through our 10+1 predictions, that’s two predictions correct, eight still to happen. But there’s still plenty of time…)

We also take a quick look at the news that both ICG and KKR have submitted conditional proposals for GlobalData.

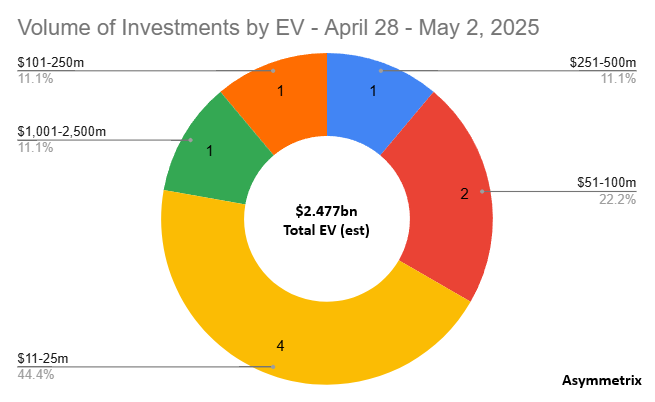

In other news, there were only a small number of acquisitions this week, but there were 9 investment rounds with a total estimated EV of $2.5bn.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Acquisition and Investment activity - April 28 - May 02, 2025

There were 3 disclosed acquisitions, with a total estimated EV of $13m.

9 investments were announced, with a total estimated EV of $2.5bn.

If you would like to have access to Asymmetrix’s underlying data via our subscription product, contact us directly at a.boden@asymmetrixintelligence.com.

Back in December we published 10 Data & Analytics predictions for 2025.

One of these predictions was:

S&P Global to divest a division - it’s traditional for new CEOs to look to make a mark on the business they take over. New CEO Martina Cheung will likely be considering updating S&P’s strategy. Would selling the Mobility division make sense?

And lo it came to pass.

Alongside their Q125 results, S&P Global announced that they would spin out their Mobility Segment.

According to S&P’s announcement:

A separation will allow Mobility more flexibility to pursue near- and long-term growth opportunities, including in used car offerings and expanding both geographically and into adjacent markets.

We don’t yet know the name of the new entity, but they have some strong brands in the portfolio that they could hark back to - CARFAX and Polk for example. But it seems more likely they will go for something modern-sounding.

It’s a relatively chunky business. In FY24, Mobility generated $1.6bn in revenue, 8% up on the previous year.

There’s still a possibility that the Mobility segment might be acquired before the spin off completes. Asymmetrix imagines that S&P Global have already fielded offers for the business from large swathes of the PE community. Perhaps S&P Global feel that there’s still more growth to be had from the business, and they’d like a piece of that action, but the business is better off at arm’s length from the rest of S&P Global.

Why was this predictable? Well, Automotive (sorry, Mobility) came to S&P Global as part of the IHS Markit acquisition, and never really felt like a fit with the acquiring firm. Mobility is too far away from the predominant financial data focus of S&P Global. A disposal of the business (whether as a spinoff or a straight sale of the business), like the sale of OSTTRA a fortnight ago, is a great way to return capital to S&P, and enable it to redeploy funds on something more in that financial data area.

Having suggested a range of $1bn-ish acquisition opportunities at the time of the OSTTRA deal, and despite last week’s (most likely smaller) acquisition of ORBCOMM’s Marine Satellite AIS data business, it now feels probable that S&P are building up towards doing a bigger deal.

Could they, for example, nab AlphaSense before it goes public? This would blow another of our predictions for 2025 out of the window.

Asymmetrix suspects that we will see some more seismic news from S&P Global before the year is out.

Asymmetrix delved into UK-HQed multi-sector Data & Analytics provider GlobalData in January this year, after a string of acquisitions (they’ve made one more since - Singapore-based consumer insights platform Ai Palette) and the announcement of a large debt facility for M&A.

We noted at the time that the broader Data & Analytics community had begun to pay closer attention to GlobalData.

Last week Bloomberg broke the story that GlobalData had received takeover interest from KKR and Intermediate Capital Group (ICG), mooting an EV above $2bn.

GlobalData promptly issued a statement in response to the article, confirming that it had indeed received conditional proposals from ICG and KKR.

As we noted in our analysis in January, owner Mike Danson has previous experience here - he sold Datamonitor to Informa in 2007 for £513m in cash, a 7x revenue multiple. GlobalData is in large part built from assets bought back later at a lower multiple.

A take private by a PE firm is a different proposition, of course, and may end up as more of a partnership than a sale. But it seems likely that this story will have more than a few twists and turns should the shareholders of GlobalData opt to take private equity money.

Interesting Content

How Gen AI is Transforming Market Research - HBR (with thanks to John Farrell)

📧 If you would like to talk, please email us at a.boden@asymmetrixintelligence.com