🌏 Talking Commodities Supply Chain Data & Analytics with Tathya.earth COO, Nikkit Shrungarpawar - Asymmetrix Newsletter #66

Combining AI with satellite imagery creates powerful Data & Analytics

Regular readers of Asymmetrix will know that two of our favourite topics are data generated from satellite imagery and artificial intelligence.

Today we have an interview with the COO of a business which combines both - Tathya.earth. Nikkit Shrungarpawar was kind enough to give us the inside story on how Tathya has grown to $1m of ARR.

In other news, Reuters has reiterated (after first stating this a year ago) that Hellman & Friedman (advised by Citi) are running a sale process for Energy & Commodities Data & Analytics provider Enverus. The estimated EV is $6bn. And CoStar have taken out another residential property marketplace - this time it’s Australian Domain, for which they are paying $1.92bn.

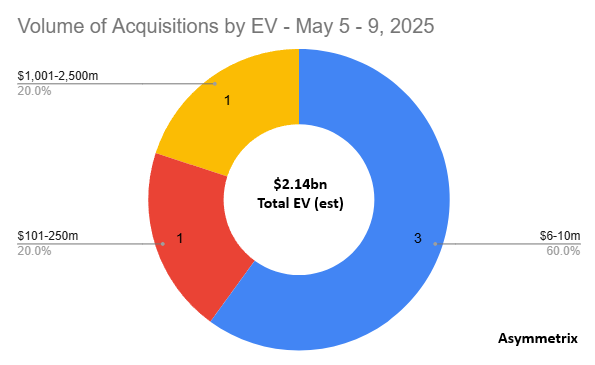

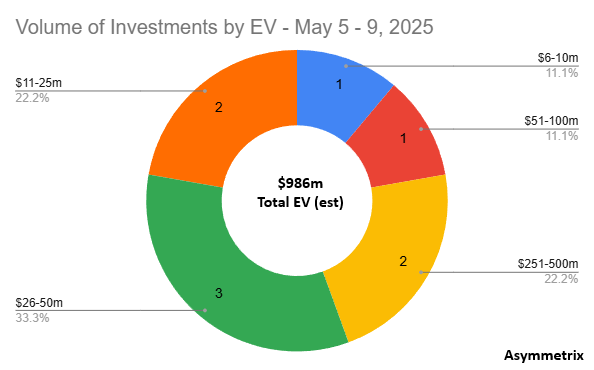

In all, last week Asymmetrix tracked 5 disclosed acquisitions, with a total estimated EV of $2.14bn, and 9 investments, with a total estimated EV of $986m.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Acquisition and Investment activity - April 5-11, 2025

There were 5 disclosed acquisitions, with a total estimated EV of $2.14bn.

9 investments were announced, with a total estimated EV of $986m.

If you would like to have access to Asymmetrix’s underlying data via our subscription product, contact us directly at a.boden@asymmetrixintelligence.com

Tathya.earth COO, Nikkit Shrungarpawar, and Asymmetrix talk Commodities Supply Chain Data & Analytics

Founded in 2019, Tathya.earth are building a platform to monitor critical assets and infrastructure impacting the global commodities supply chain in real-time. They apply machine learning on satellite images to provide data and insights on assets such as industrial units, ports and mines. Tathya sells into financial institutions, policymakers and companies in the commodities value chain like producers, traders and consumers.

Privately owned Tathya has taken pre-seed investment from angels and incubators.

The business now has roughly 50 clients, and has reached $1m of ARR with 9 employees.

You can watch the interview on YouTube or listen to it as a podcast.

(At the time of publication Apple were still uploading our latest podcast into their directory - but it may be there by the time you read this.)

Here’s a brief summary of what we covered in the conversation:

Tathya's Value Proposition - Tathya fills a key gap in commodities data by relying on alternative sources like satellite imagery instead of public company reports. This allows analysts and traders to access real-time insights into global infrastructure.

Product Maturity and Usage - The product has evolved to serve the entire commodities value chain and is actively used by researchers and institutions today. The company initially focused on ferrous commodities due to their critical role in emerging economies.

Client Growth Across the Chain - Tathya has grown its client base by expanding both upstream and downstream in the commodities chain. They’ve reached clients by tailoring insights across different commodities and industries.

Technical Development - Tathya invested heavily in developing proprietary algorithms over freely available satellite images. They combined this with on-the-ground data from diverse geographies to build robust forecasting tools.

Business Development and Early Investment - Client acquisition began through industry networks and incubator introductions. Angel investors with backgrounds in trading and shipping brought industry knowledge to the table.

Data and the AI Advantage - Tathya emphasizes that in the era of LLMs and AI, data quality is paramount. While AI tools can be commoditized, the unique value lies in proprietary data that drives better models.

Looking Ahead - The team is excited about further developing domain-specific insights, expanding the range of commodities covered, and better understanding the evolving needs of financial and industrial clients over the next 12 months.

We hope that Nikkit will join us again in a year or so to let us know about Tathya’s progress.

Interesting Content

📧 If you would like to talk, please email us at a.boden@asymmetrixintelligence.com