📈 TP ICAP to IPO ~GBP1.9bn EV Parameta Solutions Market Data business - Asymmetrix Newsletter #58

Another member of the 165+ strong public Data & Analytics cohort likely to arrive this year

TP ICAP’s Data & Analytics business (known as Parameta Solutions since 2021) has long been the subject of bankers’ desirous glances.

Last week TP ICAP announced their desire to IPO the business as early as Q2 this year. We dig into the business and consider what the future holds.

And we report on a busy week of M&A activity in the sector, with 10 deals including Enverus’ acquisition of power interconnection studies provider Pearl Street Technologies, and GlobalData Plc’s acquisition of FMCG-focused Ai Palette for what seems like a very reasonable $11.5m.

In later stage funding there were notable raises for energy forecasting provider Amperon, from National Grid Partners, and Norm AI, who took $48m from a cohort of investors including Coatue.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📧 If we missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.

Flexible Parametas

Launched in 2021 as a rebrand of TP ICAP Group plc’s data and analytics and post-trade offerings, Parameta Solutions is TP ICAP’s best-performing business unit.

With an adjusted EBITDA margin of 43% (compared with 14.3%-18.8% for the other divisions), investors have long called for Parameta to be split out from the rest of the business in order to return value to shareholders.

Last year’s decision to create a separate legal entity for Parameta was seen by analysts as a response to these calls and preparation for an ultimate sale.

What happened?

Last week TP ICAP fired the starter’s pistol on an IPO, stating that:

We are progressing strategic options for Parameta Solutions. Our focus is a listing in the United States, with the Group maintaining a majority stake. Should we proceed, with no certainty we will do so, the listing could occur as early as Q2 2025. Our priority is to create sustainable shareholder value and retain, for the long-term, the majority of any upside potential, while providing Parameta with a greater ability to grow on a standalone basis.

Should it go ahead, we would expect to return most of the proceeds of any Parameta listing to our shareholders.

It’s unclear:

How much of Parameta TP ICAP is planning to sell in the listing, although they have indicated a desire to retain majority control;

The likely valuation of the business - this will be impacted by TP ICAP retaining control, and by the fact that the data is ultimately sourced from TP ICAP’s IDB business itself, so true independence (in the event of a full takeover in due course) would not be 100% straightforward.

Why it matters

The Financial Market Data industry is enormous (estimated most recently by another TP ICAP business, Burton Taylor at $42bn in 2023), and there is plenty of opportunity within it for Parameta to expand.

The below image, taken from a 2021 Parameta Solutions Investor Seminar presentation, shows how the market segments:

Parameta, like its competitors TraditionData and Fenics, sits within the Interdealer Broker sub-segment in the top right box. But Parameta has been making progress on growing into the Pricing, Reference and Valuation, and Benchmarks & Indices segments. So there is an opportunity to build a larger business.

There is likely to be considerable appetite for Parameta given the attractive financial metrics of the sector and the business itself.

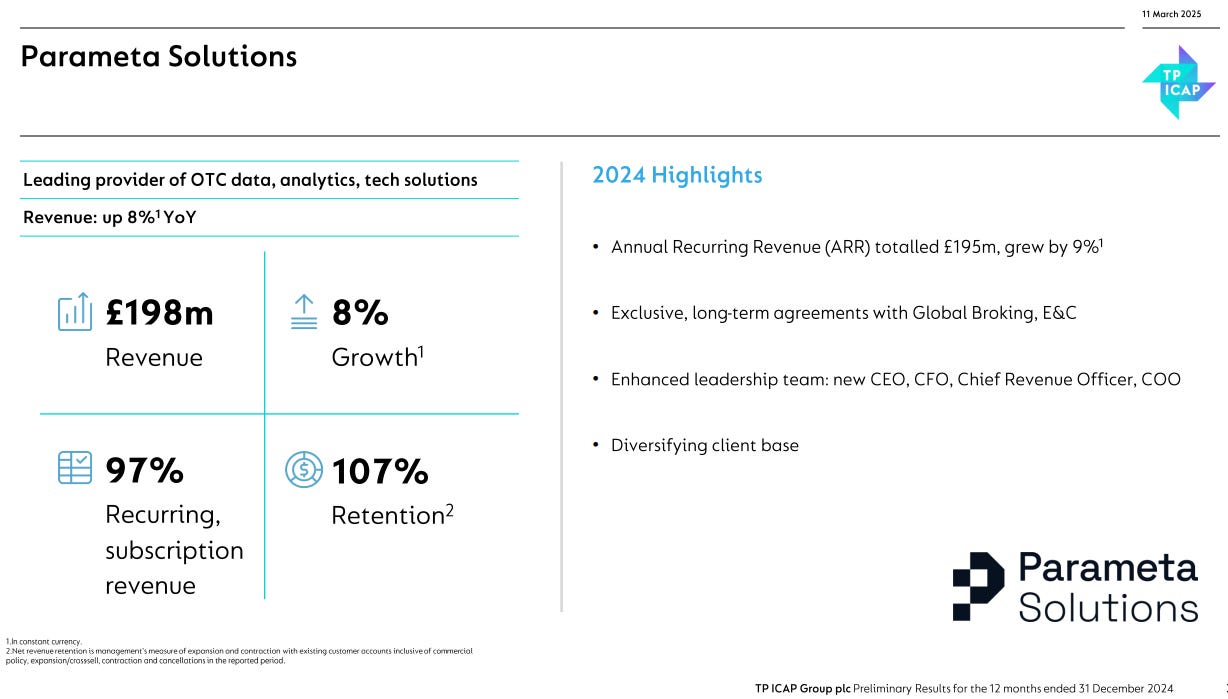

(Source: TP ICAP Group plc Preliminary Results for the 12 months ended 31 December 2024)

According to the 2021 Investor Seminar:

Most of our sales are generated from 2-year rolling license agreements. This drives a high quality, reliable, predictable revenue stream, where over 94% of our revenues are recurring. Over 98% of our license agreements renew when the license agreement matures. It is the combination of extremely high recurring revenues, and an extremely high renewal rate, that make our revenues so sticky, and yielding high quality earnings.

Ultimately, TP ICAP may, at some point, be pushed by their shareholders to divest more of Parameta, as the valuations of the two businesses diverge.

As we mentioned earlier, an exact valuation for Parameta is hard to pinpoint. Last year’s landmark Preqin/BlackRock deal at 13x forward revenues will be difficult to achieve for the reasons stated previously. But perhaps a range of 8-10x is possible.

If we assume continued 8% revenue growth then that would give FY25F revenues of GBP214m, and a valuation range of GBP1.7bn - GBP2.1bn.

What happens next?

It’s been some time since we saw a Data & Analytics IPO, so owners of other Data & Analytics businesses are likely to be watching on with interest.

TP ICAP’s competitors Tradition and BCG may consider following suit if the launch is successful;

SIX Group have previously announced that they are also considering options for their Financial Information division - would a merger with a listed Parameta make sense?

More broadly within the Data & Analytics sector there are a number of intriguing PE-owned assets which have reached a scale where an IPO is the logical next step. Hellman & Friedman, for example, were rumoured last year to be considering a potential IPO of Enverus.

The timing of IPOs is notoriously difficult to predict - the ongoing tariff spats may serve to delay matters, but TP ICAP seem set on bringing Parameta to market.

Asymmetrix look forward to tracking another public Data & Analytics business along with the 165+ already in our dataset.

Advisor News

🤝 Leonis Partners merges with JEGI CLARITY

Leonis Partners is a private New York, New York, USA-based advisory firm serving the software, fintech, and technology sectors.

JEGI CLARITY is a private New York, New York, USA-based M&A advisory firm serving the media, marketing, information, and legal market sectors.

The combined entity will be known as JEGI CLARITY LEONIS.

M&A and Fundraising

Deal chatter

✈️ Potential Jeppesen acquirers offered $3-3.5bn debt financing by Citi and Apollo

Jeppesen is a Denver, Colorado, US-based provider of intelligent information solutions across the aviation ecosystem, owned by Boeing Inc.

According to Bloomberg, Citigroup Inc. and Apollo Global Management Inc. are offering potential buyers of Boeing Co.’s Jeppesen navigation unit the option to fund the acquisition via the pair’s nascent private credit partnership.

Jeppesen is estimated to be worth between $6bn-$8bn.

Asymmetrix Sector: Aviation.

📈 TP ICAP considers US IPO for Parameta Solutions in Q2 2025

Parameta Solutions is a London, UK-based OTC market data provider, a subsidiary of TP ICAP.

According to a Press Release, TP ICAP are “progressing strategic options for Parameta Solutions. Our focus is a listing in the United States, with the

Group maintaining a majority stake. Should we proceed, with no certainty we will do so, the listing could occur as early as Q2 2025.”

Potential valuation was not disclosed, but Parameta Solutions had revenue of GBP198m and adjusted EBITDA of GBP86m in 2024.

Asymmetrix Sector: Financial.

Announced M&A

Tempus, a NASDAQ-listed,Chicago, Illinois, USA-based precision medicine and patient care AI provider, announced the acquisition of Deep 6 AI, a Pasadena, California, USA-based AI-powered precision research platform, backed by AI Venture Labs, Brooks Hill Partners, GSR Ventures China, Healthbox, and Iaso Ventures.

Financial terms were not disclosed.

Asymmetrix Sector: Healthcare.

tmGroup, a Swindon, Wiltshire, UK-based provider of property data and technology solutions, backed by AURELIUS, announced the acquisition of Veya, a private, Manchester, UK-based title deed analysis and early warning platform.

Financial terms were not disclosed

Asymmetrix Sector: Legal.

Topicus, a TSX-listed, Deventer, Overijssel, Netherlands-based vertical market software company, announced the acquisition of MoneyView, a private Amsterdam, Netherlands-based financial product data provider.

Financial terms were not disclosed.

Asymmetrix Sector: Financial.

⚡ Enverus acquired Pearl Street Technologies

Enverus, an Austin, Texas, USA-based energy-dedicated SaaS platform, backed by Hellman & Friedman and Genstar Capital, announced the acquisition of Pearl Street Technologies, a Pittsburgh, Pennsylvania, USA-based provider of automation solutions that streamline interconnection studies for transmission providers, utilities and energy developers, backed by VoLo Earth, Pear VC, Powerhouse Ventures, and Incite.

Financial terms were not disclosed.

Asymmetrix Sector: Power Generation, Renewables.

🏘️ Green Street acquired Australian Property Journal

Green Street, a Newport Beach, California, USA-based real estate data and analytics provider, backed by TA Associates and WCAS, announced the acquisition of Australian Property Journal, a private, Melbourne, Victoria, Australia-based publication for commercial property and residential real estate.

Financial terms were not disclosed.

Australian Property was advised by Ted McDonnell of McDonnell Advisory.

Asymmetrix Sector: Real Estate.

🎥 Cinelytic acquired Jumpcut

Cinelytic, a Los Angeles, California, USA-based content intelligence platform for the global entertainment industry, backed by T&B Media Global, announced the acquisition of Jumpcut, a Los Angeles, California, USA-based provider of AI-driven IP management and audience analysis tools, backed by Atomic.

Financial terms were not disclosed.

Asymmetrix Sector: Entertainment.

🩺 Gleamer acquired Pixyl and Caerus Medical

Gleamer, a Paris, France-based AI medical imaging company, backed by Supernova Invest, Heal Capital, XAnge, Elaia, Bpi France, MACSF, UI Investissement and Crista Galli Ventures, announced the acquisition of Pixyl, a Grenoble, Isere, France-based neurology and radiology software firm, backed by ITTranslation Investment, Crédit Agricole and Davycrest Nominees, and Caerus Medical, a private, Paris, France-based brain imaging company.

Financial terms were not disclosed.

Asymmetrix Sector: Healthcare.

🏛️ Euna Solutions acquired AmpliFund

Euna Solutions, a Chicago, Illinois, USA-based public sector SaaS platform, backed by GI Partners and Golub Capital, announced the acquisition of AmpliFund, a Cleveland, Ohio, USA-based grant management platform provider, backed by investors including First Analysis, North Coast Angel Fund, Hyde Park Angels.

Amplifund was advised by Lightning Partners.

Financial terms were not disclosed.

Asymmetrix Sector: Public Sector.

⚡ Yes Energy LLC acquired RTO Insider

Yes Energy LLC, a Boulder, Colorado, USA-based power market data provider, backed by Accel-KKR, announced the acquisition of RTO Insider, a private, Baltimore, Maryland, USA-based electric markets data provider.

Financial terms were not disclosed.

Asymmetrix Sector: Power Generation.

🧃 GlobalData Plc acquired Ai Palette

GlobalData Plc, an LSE-listed, London, UK-based data, insight, and technology company, announced the acquisition of Ai Palette, a Singapore-based consumer insights platform, backed by InnoVen Capital and Orzon Ventures.

The purchase price was $11.5m.

Ai Palette was advised by Allied Advisers.

Asymmetrix Sector: Consumer.

Later-Stage / Growth funding

🏘️ reAlpha

Dublin, Ohio, USA-based real estate technology company.

Raised $5m in funding from Mercurius Media Capital LP.

Asymmetrix Sector: Real Estate.

📈 Equilend

New York, New York, USA-based provider of technology, data and analytics solutions for the securities finance industry.

Raised an undisclosed amount in funding from The Bank of New York Mellon Corporation (BNY).

Asymmetrix Sector: Financial.

💡 Amperon

Houston, Texas, USA-based provider of AI-powered energy forecasting and analytics solutions.

Raised an undisclosed amount in funding from National Grid Partners.

Asymmetrix Sector: Power Generation.

🎯 Rep Data

New Orleans, Louisiana, USA-based provider of research data and fraud prevention solutions.

Raised an undisclosed amount in funding from Mountaingate Capital.

Canaccord Genuity advised Rep Data.

Asymmetrix Sector: Market Research

Nashville, Tennessee, USA-based digital executive protection platform.

Raised $35m in growth funding from FTV Capital.

Asymmetrix Sector: Cyber Security.

⚠️ Norm Ai

New York, New York, USA-based regulatory AI agent company.

Raised $48m in funding from backers including Coatue, Craft Ventures, Vanguard, Blackstone Innovations Investments, Bain Capital, New York Life Ventures, Citi Ventures, TIAA Ventures, and Marc Benioff.

Asymmetrix Sector: GRC.

Early-Stage

🔍 Podqi

San Francisco, California, USA-based automated IP protection platform.

Raised $3.2m in seed funding led by General Catalyst, with participation from Soma Capital, Afore Capital, and strategic angel investors.

Asymmetrix Sector: Intellectual Property.

Paris, France-based startup innovating precision medicine solutions in oncology.

Raised EUR1.6m in seed funding led by Calyseed, with participation from Plateau de Saclay Business Angels, Yes Invest and Capital Cell.

Asymmetrix Sector: Healthcare.

⚖️ Lexroom.ai

Milan, Lombardy, Italy-based AI-driven legal research platform.

Raised EUR2m in seed funding led by Entourage, and including Verve Ventures, Vento Ventures, Banyan Ventures, and X-Equity advised by FNDX.

Asymmetrix Sector: Legal.

Interesting Content

Learning to Learn with AI - David Worlock

Hedge Funds Need to Know the Weather - Matt Levine, Bloomberg

Inside the Vals.ai report: where does AI already beat lawyers? - Richard Mabey, Juro

📧 If we have missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.