🔥 Flaming June - Asymmetrix Newsletter #73

Data & Analytics M&A and investments on fire in June.

A break from the norm this week. We review sector activity from June and highlight a few themes that caught our attention.

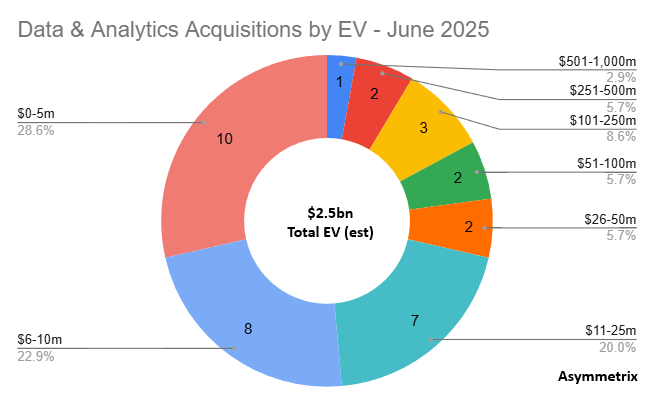

Overall, there were 73 Corporate Events in June. There were 35 disclosed acquisitions, with a total estimated EV of $2.5bn, and 38 disclosed investments, with a total estimated EV of $8.1bn.

Although there was activity across the month, we saw some big deals announced in the last week including:

Yesterday Clio announced that they had acquired vLex for $1bn;

On Friday last week, news broke that Advent-backed NIQ had filed for a $1.25bn IPO at a $10bn valuation;

Envestnet, taken private by Bain Capital last year, finally divested its consumer financial data platform, Yodlee, to STG;

Legal AI leader Harvey announced that they had raised a $300m Series E at a $5bn valuation.

We dig into the themes in more detail below.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📈 Acquisition and Investment activity - June 1-30, 2025

Overall, there were 73 Corporate Events in June. Activity was pretty evenly split between investments and acquisitions.

There were 35 disclosed acquisitions, with a total estimated EV of $2.5bn.

38 investments were announced, with a total estimated EV of $8.1bn.

And now for the trends.

Retail & Consumer Data & Analytics was incredibly busy

We wrote about this sector twice during June:

Deals included:

Apax-backed IWSR acquired by WGSN from Bowmark;

SPINS (backed by Warburg Pincus, General Atlantic and Georgian) bought two businesses across the month: Lucky Labs and Datasembly;

New Mountain- and Endicott-backed Datassential acquired Brizo FoodMetrics;

Tastewise raised $50m from a range of VC firms;

Mintel acquired Black Swan Data.

And on Friday last week, news broke that Advent-backed NIQ had filed for a $1.25bn IPO at a $10bn valuation.

Why the focus on the Retail & Consumer Data & Analytics sub-sector right now? There’s too much activity for this to be a coincidence.

We liked Eugen Kaprov’s thesis that “food is just data with a shelf life”. Consumer brand owners and retailers are wising up to the fact that they can increase profits in a tight consumer market by focusing relentlessly on data.

And canny investors are seeing the opportunity to deploy capital in and consolidate the related Data & Analytics sector.

Legal Data & Analytics continues to post huge numbers, driven by AI

Last week Legal AI leader Harvey announced that they had raised a $300m Series E at a $5bn valuation, only four months after a similarly eye-popping $300m Series D raise at a $3bn valuation.

Both rounds included REV, the venture arm of RELX, which owns LexisNexis Legal & Professional.

The week before the most recent round LexisNexis and Harvey announced a strategic alliance “to integrate LexisNexis generative AI technology, primary law content, and Shepard’s Citations within the Harvey platform and jointly develop advanced legal workflows”.

So now we have RELX and Harvey in one corner, and Thomson Reuters and Microsoft Copilot (built on OpenAI) in the other.

But who’s this entering the ring?

Yesterday, news broke that Clio had acquired vLex for $1bn!

And smaller competitors continue to raise money to get involved in the fight. Earlier in June, Wordsmith AI raised a $25m Series A.

Financial Services-focused Data & Analytics

Ever the beating heart of Data & Analytics, the Financial sub-sector saw a range of transations. The bigger deals included:

Permira-backed Octus, formerly Reorg, acquired credit management platform Sky Road;

TP ICAP acquired Neptune Networks from the consortium of banks who had helped to get the pre-trade bond data platform off the ground;

CUBE (backed by Hg) acquired non-financial risk analysis platform Acin;

Last week saw Envestnet, taken private by Bain Capital last year, finally divest its consumer financial data platform, Yodlee, to STG.

Fundamentally, financial services is a data-driven industry. It’s no surprise that Data & Analytics businesses prosper in this sector.

wrote a well-received piece for us on Private Markets Data & Analyticsand it was exactly a year ago that news broke of BlackRock’s £2.55bn acquisition of Preqin.

It feels like we are due another seismic moment in the Financial Data & Analytics sub-sector soon.

ESG quietly chugging along in the background

In a world dominated by Trump tariffs and geopolitical uncertainty, Environmental, Social and Governance Data & Analytics is getting less attention.

But investment in the sector has not stopped, driven in part by ESG regulation coming into effect and companies purchasing software to help them to be compliant.

Last month, for example:

Treefera raised $30m for supply chain resiliance;

Pano AI, AI-powered wildfire detection provider, raised a $4m Series B;

Climate intelligence platform Climatiq raised $10m.

This is very much a global sector. The three companies above come from California, Germany and the UK. And we are seeing increasing volumes of activity in Asia, particularly Japan.

If you would like to have access to Asymmetrix’s underlying data via our subscription product, contact us directly at a.boden@asymmetrixintelligence.com